KNOWLEDGE IS POWER

Cascade Chalet for Sale

76122 NE 122nd St, Skykomish, WA 98288 Erik Zaugg and Joe Klarman are proud to present this unique …

Modern Elegance in the Heart of the City

420 26th Ave S #B, Seattle, WA 98144 Presented by Joe Klarman & Erik Zaugg Chic, Modern & …

Modern Luxury Living in Bryant: A Showcase of …

Modern Luxury Living in Bryant: A Showcase of Elegance 7041 34th Ave NE, Seattle, WA 98115 Discover the …

Amazing Condo for Sale in Snohomish

14007 69th Dr SE Unit #D3, Snohomish, WA 98296 Light-filled and spacious, this amazing condominium provides a perfect …

King County Report - Dec 2023

King County Real Estate Market Report December 2023 Summary Real estate prices in the King County market …

Whittier Heights Home — Closed!

833 NW 67th St, Seattle, WA 98117 Erik Zaugg and Joe Klarman helped their client negotiate the price …

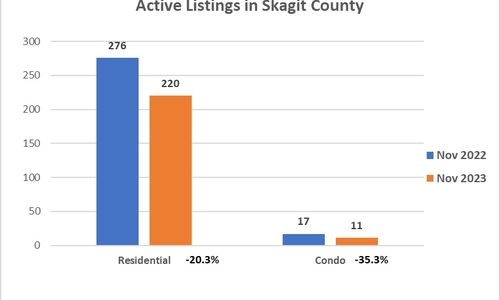

Skagit County Real Estate Market — November 2023

Skagit County Real Estate Report for November 2023 The Skagit County real estate market remained tight, as expected, …

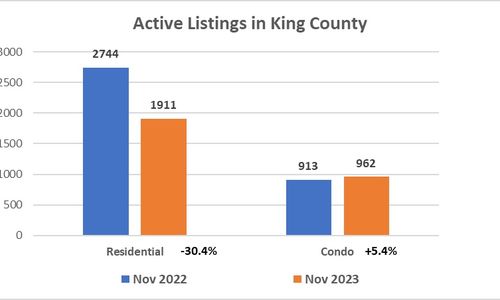

King County Report — November 2023

King County Real Estate Report for November 2023 The real estate market in King County remained tight, as …

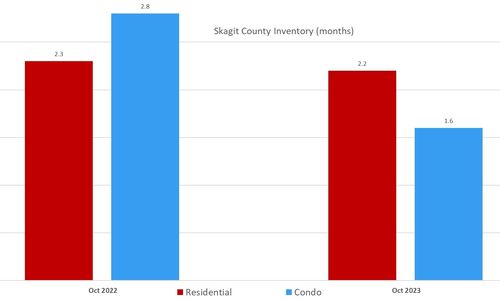

Skagit County Report — October 2023

Skagit County Housing Prices Continue Upward Overview Skagit County residential prices increased 5.6% in October compared to …

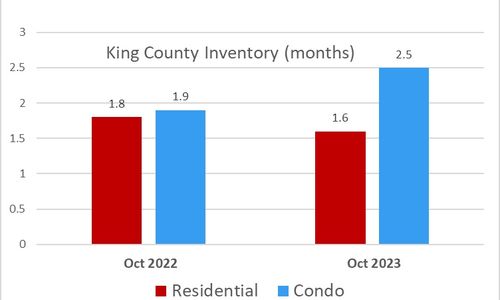

King County Report — October 2023

King County Real Estate Market Remains Robust Introduction The King County real estate market continues to be …